The fall in Brent brings exporting countries’ currencies and bonds down with it.

By Andrea Gennai

The collapse in the oil price is becoming a potential destabilising factor for the international financial markets. The benefits in terms of lower costs for businesses and consumers have definitely taken a back seat in view of the overly abrupt fall in the most strategic international commodity.

Yesterday, the epicentre of the earthquake was once again Moscow: the stock exchange lost 10% (Russian Trading System (RTS) index in dollars), with the ruble losing the same amount of ground against the euro. The never-ending fall of oil and Russian assets is starting to attract the attention of investors and small savers. ETF and ETC, which invest, respectively, in Russian stocks and in crude, are listed in Milan. But the experts have urged investors to exercise great caution, because the downwards movement in oil (to which the Russian stock exchange is closely linked) could still have some way to go. There’s fertile terrain to exploit further movements, but that’s best left to expert investors.

“It’s clear that the topics of Russia and oil are very closely linked”, is the comment of Claudio Barberis, asset allocation director at MoneyFarm. “But it’s difficult to calculate the potential damage. Russia lives on oil and little else. Buying into Russia right now is too risky. The market earnings ratios are at less than 10 and it’s one of the most interesting markets in the world. Prices are at bargain basement levels. But earnings have been at the same levels for the last 3 or 4 years. We need to review the whole scenario and we won’t discover the true price/earnings ratio until next year. Betting on oil is also very risky right now. Oil is an important economic asset at the global level: a violent shift like this creates havoc, which we’re only seeing now. I wouldn’t be in any rush to buy it”.

Asset managers are also very alarmed about the repercussions of commodities’ performance on bonds.

“The continuing widening of the spread between high-yield corporate US and government bonds is cause for concern”, comments Luca Riboldi, chief investment officer at BANOR. “A phenomenon caused primarily by the fall in crude prices, which could lead to defaults in numerous bonds linked to the energy sector”.

The ruble has dropped 10% against the euro, with a fall of 30% over two weeks. A clear signal of the wholesale flight of capital from Moscow, say the experts. And Moscow itself is one of the regions most at risk of oil-related instability – along with, in all probability, Venezuala. But there are also domestic factors weighing down on Russia.

As Paul McNamara, Investment Director at Gam and manager of the Gam Star Emerging Market Rates fund, underscores, “Russia is in the spotlight because its finances depend so heavily on oil and gas exports. The country has no other raw materials to export, so it can’t offset the lower revenues resulting from the falling oil price with growth in other sectors. Russia’s high levels of corruption and its structural backwardness make it one of the very few countries in the emerging world where the situation is getting worse rather than better”.

Many experts are of the view that the weakness of the raw materials market is set to persist over time, given that commodity market cycles can last for many years.

We should be paying close attention to currencies linked to the world of commodities. “In addition to the ruble”, continues McNamara, “which in recent weeks has seen a sharp depreciation, not least following the sanctions imposed by the West, the currencies of other raw materials exporters, such as South Africa, Chile and Colombia, have also weakened. A situation of weakness that has also extended to those countries’ bond markets”. The warning, therefore, is to weigh up any investment in these regions carefully, considering that the other side of the high earnings coin is the risk of heavy devaluation.

ADVICE

The experts’ view is that the weakness in the raw materials market could last a lot longer

Variables under the lens

The euro-ruble exchange rate – performance over 2014.

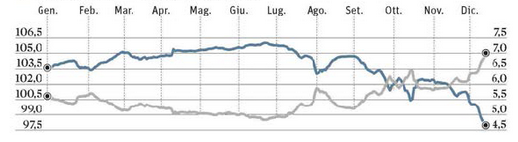

Brent Futures performance for the period on the ICE market – values in dollars

Performance of the Barclays US Corp High Yield bond index since the start of the year – listings and yields

— Price (left axis) — Yield % (right axis)

Original article in Italian language, available here: Il Sole 24 Ore, December 14, 2014.

The contents provided for in this section have not been audited by independent bodies. There’s no warranties, expressed or implied, regarding reliability, accuracy or completeness of the information and opinions contained. The informations are not based on assessment of the adequacy and do not consider the risk profile of the possible recipients, and therefore, should not be construed as personal recommendation and does not constitute investment advice, according to the Italian Legislative Decree n° 58/98. The contents of this site may not be reproduced or published whole or in part, for any purpose, or disclosed to third parties.