Funds: The volatility of the bonds market and the most unstable stock markets are bringing mixed funds back into favour.

WELL BALANCED RISKS

By Paola Valentini

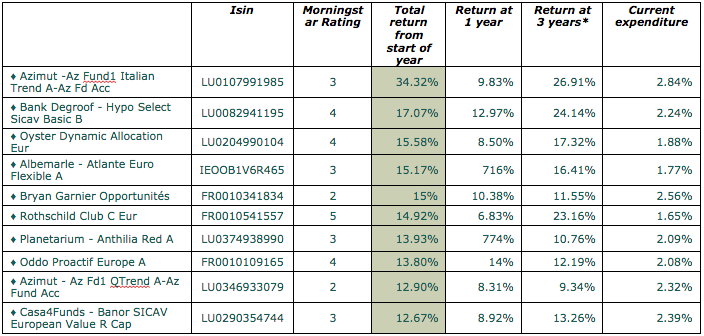

Half-way between bonds and shares, “balanced funds” are the route chosen by investors who wish to dip their toe in the stock exchange without being overly exposed to equity. A welcome move right now for those trying to leave the safe haven of shares. According to figures produced by Assogestioni at 30 April 2015, since the start of the year Italy has seen balanced funds attract 8.4 billion euro out of a total of 50.2 billion. The trend is gathering pace with respect to last year, when balanced funds accounted for 11.4 billion compared with a total of 91.4 billion flowing into open funds. This shift is a reaction to the uncertainty of markets that are looking with ever-growing anxiety to the moves of the central banks. The markets’ perception of the intentions or actions of the Fed has on several occasions been the cause of widespread market volatility. The wave of sales on the global bond markets between April and early May suggests that we could once again be in just such a period of volatility. Funds Investors fear that the increase in yields and the fall in prices of bonds, a trend that began in late March, could be merely the prelude and that 2015, like 1994, could become sadly famous for the market volatility generated by the Fed. “In 1994, under the leadership of Alan Greenspan, the Federal Reserve surprised the financial markets by raising interest rates”, warns Andrew Harmstone, Global Balanced Risk Control manager at Morgan Stanley Investment Management. It is no coincidence that from the network of financial advisers a clear preference for balanced funds is emerging. During their road show in March, Raiffeisen Capital Management interviewed a sample of financial advisers, private bankers and banking operators on their approach to investment and the different asset classes. Road-show participants were asked which type of fund they intend to use in their clients’ portfolios in the coming months. The majority preferred balanced and flexible funds (46%), followed by equity funds with the focus on Europe (35%) and global equity funds (25%). Next came flexible bond funds, with 21% of the preferences, and emerging country equity funds (16%). “Flexibility in bond fund management will be essential in a macro-economic context where uncertainties as to inflation weigh more heavily than those concerning growth”, states Didier Saint-Georges, Managing Director and Member of the Investment Committee of Carmignac in his June note. “Bond, equity and foreign exchange turbulence in recent weeks has confirmed that financial markets have lost much of their flexibility. They have become vulnerable to the slightest deviation from the perfect scenario, namely: sufficient growth, on-going monetary stimulus and stabilized inflation trajectory. The scale of market volatility will depend on how these three factors match expectations”. A number of shortcomings emerge from this assessment, of which the prospect least expected by the markets is that of inflation picking up in the second half of the year, concluded Saint-Georges. Morningstar has selected the ten best balanced euro funds for MF-Milano Finanza, in terms of return since the start of the year. In first place is Azimut’s Az Italian Trend, with an increase of 34.3%, followed by Hypo Select Sicav Basic, +17.07%, and Oyster Dynamic Allocation, up 15.5%.

THE TOP TEN BALANCED FUNDS BY RETURN FROM START OF YEAR

*Annualised Morningstar balanced euro categories. The funds are sold in Italy with retail access (minimum initial investment less than 10,000 euro). Returns are in euro at 10 June 2015. Current expenditure, again in euro, is up-dated to the latest KIID available. All the funds are flexible balanced, except for Atlante Euro Flexible (moderate balanced) and Banor Sicav European Value (aggressive balanced). Source: Morningstar Direct. Performance in euro at 10 June 2015. Disclaimer: The content of this section has not been verified by independent bodies. No explicit or implicit guarantee is provided regarding the reliability, accuracy or completeness of the information and opinions provided. Said information and opinions are not based on any evaluation of their suitability and do not take the risk profile of recipients into account. They are not, therefore, intended as personalised recommendations and do not constitute investment consultancy or advice under the terms of Legislative Decree 58/1998. The content of the site may not be reproduced or published in full or in part for any purpose, or disclosed to third parties.

Original article in Italian language, available here: Milano Finanza, June 20, 2015.

The contents provided for in this section have not been audited by independent bodies. There’s no warranties, expressed or implied, regarding reliability, accuracy or completeness of the information and opinions contained. The informations are not based on assessment of the adequacy and do not consider the risk profile of the possible recipients, and therefore, should not be construed as personal recommendation and does not constitute investment advice, according to the Italian Legislative Decree n° 58/98. The contents of this site may not be reproduced or published whole or in part, for any purpose, or disclosed to third parties.