The banks are overseeing the country’s fortunes.

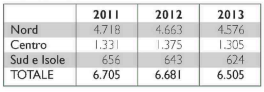

The distribution of “pure” private bankers in Italy

by Massimo Morici

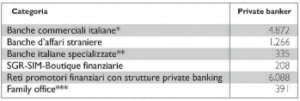

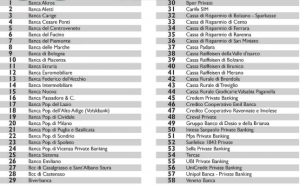

Private banking in Italy is conducted mainly in branch offices. The country’s commercial banks control the biggest slice of the pie: over half of assets under management through private services. The snapshot emerges from the latest report published by Magstat, the consultancy led by chairman Marco Mazzoni. At 31 December 2013, the 58 Italian commercial banks operating in the sector through their own internal divisions or through independent banks were managing 522,702 customers and assets amounting to 359.5 billion euro (up 11.23% on 2012, and an increase of 4.05% in the assets managed by the specialist banks) – a figure that equates to 53% of the market served. 4,872 private bankers are currently operating in the sector. UniCredit PB, Intesa Sanpaolo PB and UBI Banca together control 37.6% of the market (255 billion). If we consider the first 5 banking groups (including Banco Popolare and Bnl–BNP Paribas), the share rises to 45.4%. And if we take the first 10 operators, which include the Swiss colossuses UBS and Credit Suisse and the Italian Veneto Banca, Banca Mps and Credem, the share rises to 60.6%. Over a quarter – 26.3%, or 242 billion euro – of the Italian market is not yet covered by private banking services.

Estimates: MAGSTAT data at 31/12/2013. The table shows the estimated distribution of private bankers working in commercial banks, foreign business banks, specialist Italian banks and SGR-SIM-Financial Boutiques throughout the country. It does not include Type 5 and 6 financial advisers (FA networks with private banking and Family Office structures).

The 58 Italian banks operating in the private banking sector

FAMILY OFFICES

Italy has 120 family offices, with 391 family officers following 13,106 clients (of which 439 households). At the end of 2013 they had 55.9 billion euros under management (up 4.09% on 2012), equating to 8.2% of the market. Unione Fiduciaria, Tosetti Value SIM and Argos hold 31.6% of the segment managed by family offices and 2.6% of the private market served.

SGR, SIM, BOUTIQUES

The 22 financial boutiques, SGRs and SIMs, which use the services of 208 private bankers and have 12,883 clients, had 18.1 billion euro under management at 31 December 2013 (down 4.33% on the figure for 2012), or 2.7% of the market served. Ersel SIM, Banor SIM and Finint Alternative IM SGR account for 59.7% of the market managed by these operators (1.6% of the total).

Source: MAGSTAT – figures at 31/12/2013

*Italian Commercial Banks with private banking divisions or with specialist autonomous banks specialising in private banking. **Italian independent banks specialising in private banking. ***Family Offices (single and multi), professional practices (lawyers – accountants) offering family office services, trustee banks with family office service.

FOREIGN BANKS

At the end of 2013 the 29 foreign investment banks, which employ 1,266 private bankers, controlled 131.2 billion euro (up 13.5% on 2012 and equating to 19.3% of the market served), on behalf of 142,955 clients. BNL–BNP Paribas, UBS Italia and Credit Suisse Italy hold 51.3% of the private market managed by foreign banks and 9.9% of the private market as a whole. The foreign banks operating in Italy with private banking structures can be broken down as follows: 12 Swiss banks, 4 American investment banks, 3 French banks, 3 British groups, 3 Austrian banks, 2 major German groups, one Spanish bank and one Luxembourg bank.

FINANCIAL ADVISER NETWORKS

The 5 networks of financial advisers that include private divisions had 78 billion euro under management at the end of 2013 (up 1.09% on 2012), or 11.5% of the market served. 6,088 advisers operate in the sector, for 140,025 clients. Banca Fideuram (38.4 billion), FinecoBankWealth Management (13.5 billion) and Banca Generali Private Banking (11.9 billion) alone account for 81.9% of the private market managed by the financial advisers’ networks and 9.4% of the private market served. At 31 December 2013 Azimut Wealth Management had assets amounting to 4.4 billion euro under management, and Mediolanum Private Banking had 9.7 billion.

Original article in Italian language, available here: Advisor, October 30, 2014.

The contents provided for in this section have not been audited by independent bodies. There’s no warranties, expressed or implied, regarding reliability, accuracy or completeness of the information and opinions contained. The informations are not based on assessment of the adequacy and do not consider the risk profile of the possible recipients, and therefore, should not be construed as personal recommendation and does not constitute investment advice, according to the Italian Legislative Decree n° 58/98. The contents of this site may not be reproduced or published whole or in part, for any purpose, or disclosed to third parties.